Introduction of Generative AI in Anthem Insurance

Handling thousands of insurance claims daily is a Herculean task for any health insurance provider. The manual processes of extracting and indexing information from these claims are time-consuming, error-prone, and costly.

This case study delves into how Anthem, one of the largest health insurance providers in the United States, leveraged advanced AI technologies, including generative AI in insurance, to revolutionize its claims processing workflow, boosting efficiency and accuracy. Leveraging a robust network of healthcare professionals and facilities, Anthem offers coverage that spans from individual and family plans to Medicare and Medicaid.

Vibencode, a premier AI and generative AI solutions company, aligns perfectly with these innovative practices, offering specialized insights and expertise to further enhance such implementations.

Problem Statement of Anthem

Anthem was struggling with the manual extraction of sensitive information from claims forms and accompanying documents, which took an average of 20 minutes per claim. Given the volume of claims processed daily, this resulted in substantial labour costs and delayed services.

Anthem’s objective was to automate this process using generative AI in insurance to reduce manual labour, accelerate claim processing times, and improve overall operational efficiency.

The Solution

Anthem turned to the Service provider of Textract, a fully managed machine learning service capable of automatically extracting text, handwriting, and structured data from scanned documents. Specifically, the solution involved:

- Generative AI in insurance: Enhancing Textract’s capabilities by incorporating generative AI models to handle complex data scenarios and automate decision-making.

- Image-Processing Capability: Textract’s ability to handle various document layouts, including detecting tables and forms, made it ideal for diverse claims documents.

- Security and Compliance: Adherence to stringent security standards ensured that sensitive information was handled securely, maintaining trust with customers and regulators.

After a medical provider submitted documents through Anthem’s provider portal, the documents were stored, processed, and digitized using Textract. This service applied optical character recognition (OCR) to extract critical data, which was then indexed and classified using machine learning algorithms. The processed claim information was distributed to appropriate Anthem stakeholders efficiently and securely.

Challenges Faced

Implementing a new automated system, particularly one involving generative AI in insurance, posed several challenges:

- Data Accuracy: Ensuring that the extracted data was accurate and reliable was crucial. Any errors in data extraction could lead to incorrect claim assessments.

- Integration: Seamlessly integrating the AI system with existing workflows and databases was essential to maintaining operational continuity.

- Scalability: The solution had to scale to handle thousands of claims daily without compromising performance.

- Security: Given the sensitivity of the data, stringent security measures were mandatory to protect patient information.

Technologies Used

By adopting Textract, along with generative AI in insurance, Anthem significantly streamlined its claims-processing workflow, achieving the following results:

- Textract: For OCR and data extraction from scanned documents.

- Machine Learning Algorithms: For indexing, classification, and ensuring data accuracy.

- Data Storage Solutions: To securely store and manage the extracted data.

- Secure Access Controls: To ensure that only authorized personnel can access sensitive information.

Results Achieved

By adopting Textract, Anthem significantly streamlined its claims-processing workflow, achieving the following results:

- 80% Automation: The automation of 80% of the claims-processing workflow drastically reduced the need for manual labour.

- Enhanced Efficiency: Claims processing times were reduced from an average of 20 minutes per claim to just a few minutes.

- Cost Savings: By minimizing manual labour, substantial cost savings were realized.

- Improved Accuracy: The use of AI and machine learning ensured higher accuracy rates in data extraction.

Industry Overview and AI Solutions

The health insurance sector is fraught with operational inefficiencies and administrative burdens. Traditional manual processes are not only slow but also prone to errors. Industry challenges include:

- Large Volumes of Data: Managing and processing vast amounts of data efficiently.

- Regulatory Compliance: Ensuring adherence to evolving regulations and standards.

- Customer Expectations: Meeting increasing customer demands for faster service delivery.

- Cost Management: Balancing operational costs while delivering high-quality services.

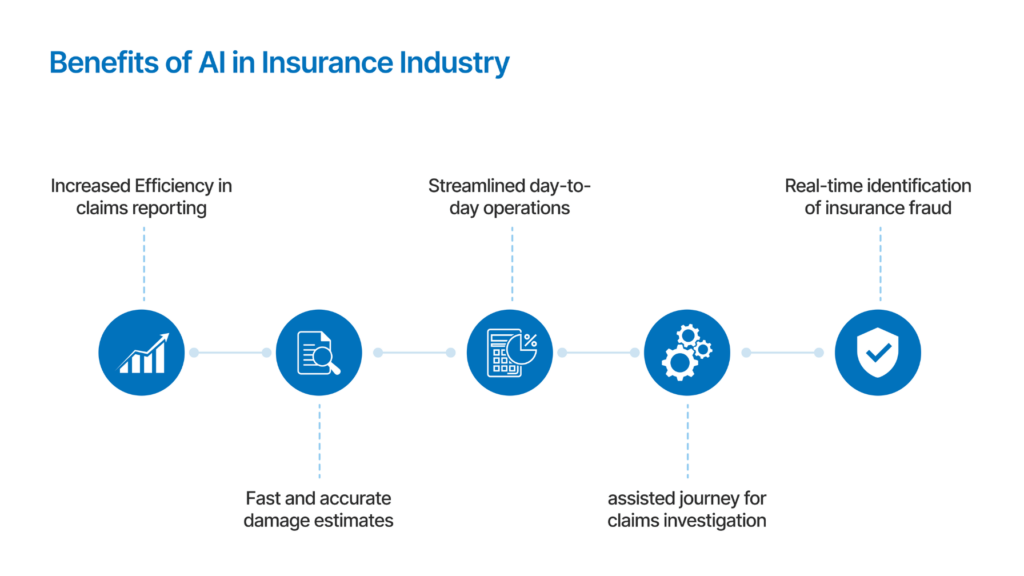

Generative AI in insurance use cases can offer promising solutions to these challenges, including:

- Automated Document Processing: AI can automate the extraction, indexing, and classification of data from various documents, reducing manual labour and errors.

- Predictive Analytics: Leveraging AI to predict claim outcomes and potential fraud, thereby improving decision-making and risk management.

- Personalized Customer Service: AI-powered chatbots and virtual assistants provide personalized support, enhancing customer experience and satisfaction.

- Operational Efficiency: Streamlining administrative tasks and workflows through AI-driven automation.

How Vibencode Can Help You

Vibencode masters the realm of AI and generative AI solutions, delivering unmatched expertise for healthcare insurers aiming to modernize their operations. Our offerings integrate effortlessly with current workflows, minimizing disruption and boosting efficiency.

Vibencode’s AI-driven strategies cater to industry-specific requirements, offering secure, scalable, and robust solutions that significantly boost business value.

Conclusion

The case of Anthem’s transformation illustrates how AI can be harnessed to address critical pain points in the health insurance industry. Through AI and machine learning technologies, including generative AI in insurance, companies can achieve faster, more accurate, and cost-effective processes.

Vibencode stands ready to assist organizations in their digital transformation journeys, leveraging our deep expertise in AI to unlock new levels of operational excellence and customer satisfaction.

Contact Vibencode to learn how our AI solutions can revolutionize your business operations, delivering efficiency, accuracy, and exceptional value.